-

Targeting High-Grade Gold in

Targeting High-Grade Gold in

Western AustraliaRipasso Precious Metals Corp.Contact us

Ripasso Precious Metals Corp.

Ripasso Precious Metals Corp. (”Ripasso”) is a gold exploration company focused on orogenic and greenstone belts in top-rated mining jurisdictions globally.

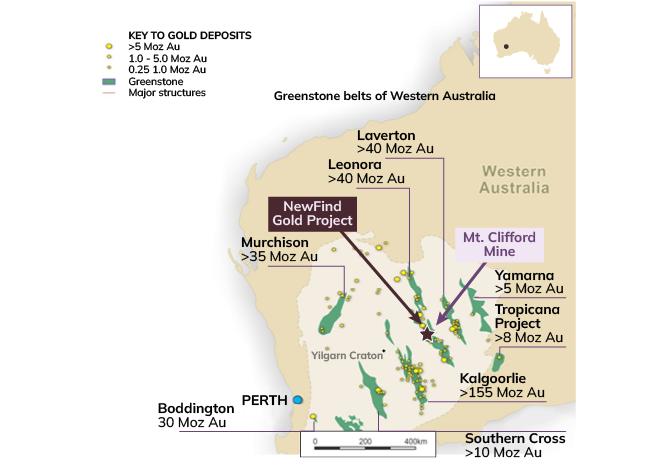

The company has the right to 100% interest in three land packages comprising the 1,456-hectare NewFind Gold Project, located in the Leonora-Wiluna gold belt of Western Australia, north of the >10 Moz Gwalia gold mine, and between two of Australia’s top 20 gold deposits, with historical workings showing high-grade mineralization.

Scientific Excellence • Sustainability • Leadership • IntegrityExperienced Leadership Team

Founded and led by a team of expert geologists with a track record of exploration success across many jurisdictions including Western Australia and commodities including gold.

Safe and Mining-Friendly Jurisdiction

Located in a world-class, gold-producing district with resources >25 Moz at camp, within the Leonora Gold belt, north of the >10 Moz Gwalia gold mine.

Outstanding Asset with Multiple Exploration Targets

Targets beneath a past-producing, near-surface, high-grade mine (the Mt Clifford shear zone). Additional permitted high potential targets within a >2500 m gold-in-soil anomaly and over 17 target areas identified along the parallel and secondary structural trends, supported by completed geological, geochemical and geophysical field research.

Excellent Infrastructure

Near main state highway, supply centre within one hour's drive, natural gas pipeline and drill water access on site, within trucking distance of at least 3 processing plants including the under-capacity KOTH plant.

Ripasso Leadership Team

Darren Lindsay

Non-Executive Chairman

& Director

Darren Lindsay is a professional geologist with over 20 years of experience in gold exploration at the belt scale. Darren was part of the team that delivered value in the Hope Bay, Beardmore-Geraldton, Rankin Inlet, and High Lake Greenstone belts.

Paul Koros

CEO, President & Director

Paul Koros leads two private investment funds, one focused on junior exploration. For over 25 years, Paul has served as a business strategist, professional engineer, angel investor in the technology sector, mentor, and advisor in a BC Venture Acceleration Program.

Daniel Vega

Director

Daniel Vega is a mining engineer and entrepreneur. He is the owner and General Manager of MPM Ltda, a mining services company whose clients include BHP, CODELCO, and Antofagasta Minerals, amongst others.

Ross Sherlock, Ph.D.

Director

Ross Sherlock is a professional geologist with over 30 years of experience, including senior positions with Kinross Gold and Gold Fields. Professor and Chair of Exploration Targeting at Laurentian University, Ross' work focusses on greenstone belt-hosted gold and base metal deposits.

Nicole Hoeller

Director

Nicole Hoeller has over 25 years' experience in investor relations, communications, corporate financing, and M&A. Most recently she was the VP of Communications for Sabina Gold & Silver Corp., sold in Feb 2023 for $1.1 billion.

Pro Forma Capital Structure

The capital structure of the RTO creating Ripasso, as of 01 May, 2025, is approximated as follows:

| Private Co (Scramble) shares outstanding | 29,000,000 |

| Private Co (Scramble) options and warrants outstanding | Nil |

| Private financing underway | 4,000,000 |

| Private Co (Scramble) fully diluted shares outstanding, pre-RTO | 33,000,000 |

| Shares issued for RTO and concurrent financing | To be determined |

Milestones

Over $4.1 million cash raised for confirmation drilling, RTO, and property purchases - Completed

Trading resumption – 4Q 2025

Marketing program launch – 4Q 2025

Financing for discovery drill program – In progress

Targeted drilling on > 2.5 km geochemical / geophysical / structural anomaly – 4Q 2025 / 1Q 2026

Expansion of land package – In progress